In response to the COVID-19 Coronavirus outbreak, the French national and regional authorities have put into place concrete and immediate support measures for businesses that are experiencing proven difficulties in the deployment of their activity in France. These measures, delivered as part of France’s COVID-19 Economic Response Plan, will provide financial support to French businesses to help them mitigate the economic impact of the Coronavirus outbreak.

The following document provides information regarding the current Economic Response plan, especially about:

- Tax measures;

- Business cash-flow measures;

- Part-time activity and social contributions;

- Legal Support.

Please note the following measures may likely be reconsidered as the current situation evolves.

For up-to-date information and contacts, please see the useful information section.

Tax measures

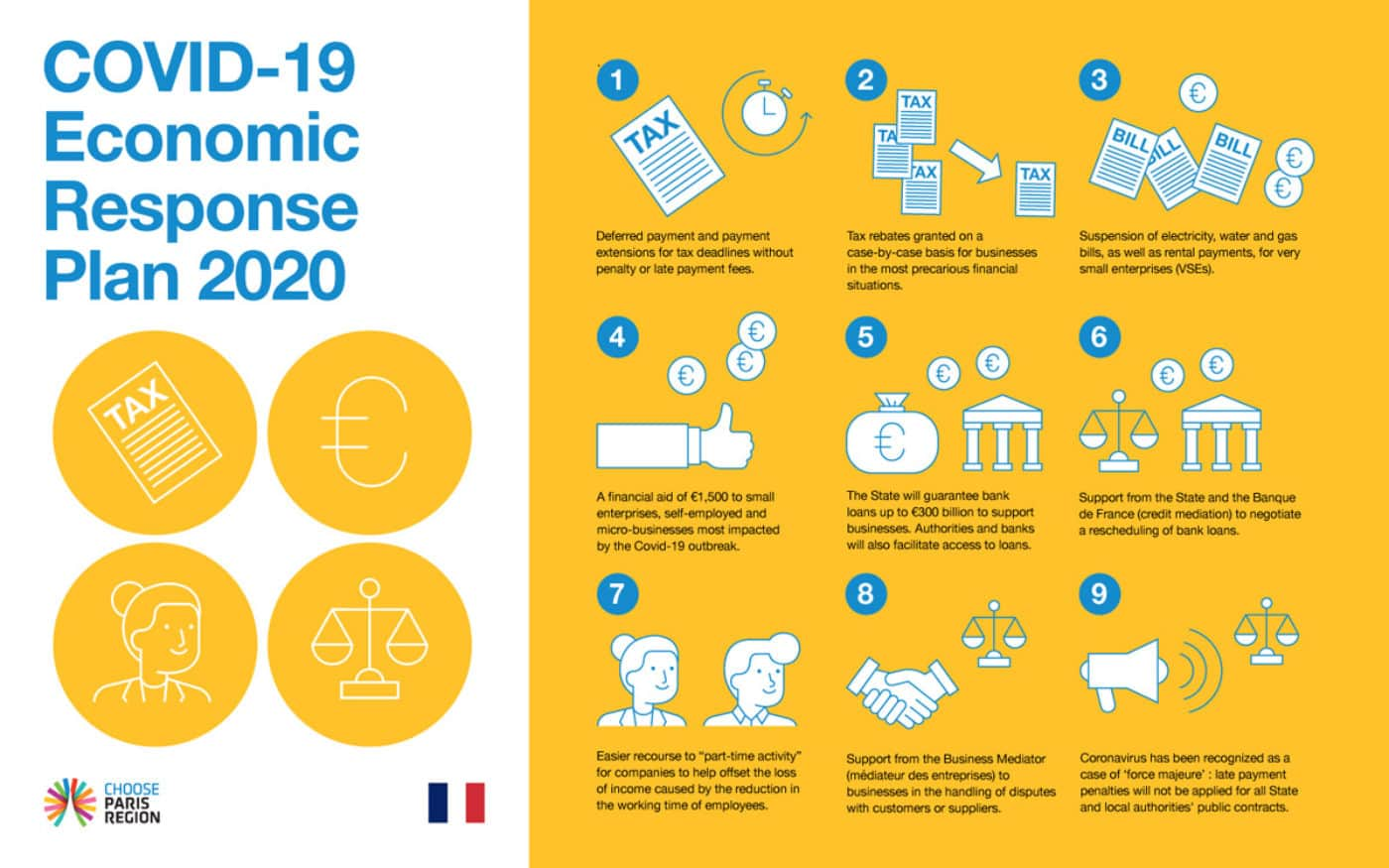

Companies that encounter cash flow problems will be eligible to the following tax measures:

- Deferred payment and payment extensions for tax deadlines

- For taxes, on the online platform impots.gouv.fr , or via the following link

- Direct tax rebates will be granted to businesses facing severe financial difficulties. These rebates will be granted on a case-by-case basis.

- Deferral of all or part of employee and employer contributions via the URSSAF website for employers and self-employed workers. The deferral applied to all social taxes and contributions which were to be paid to the URSSAF by March 15th, 2020 and in particular:

- Social security contributions (sickness, maternity, invalidity and death, old age, family, work accidents and work diseases);

- Autonomous solidarity contribution (“CSA”);

- Social contributions (“CSG” and “CRDS”);

- Unemployment insurance contribution;

- Salary guarantee contribution.

- The deferral terms are as follows:

- As of right and not sector-based (no justification to be provided to the URSSAF);

- Deferral will be possible up to 3 months without penalty or late payment fee.

- Recourse to ‘part-time activity’ will be made possible and easier for businesses in order to offset the slowing down of business activities. Companies may apply for the part-time activity scheme under exceptional circumstances (Article R.5122-1 of the French Labor Code), specifying the reasons justifying the recourse to part-time activity, the foreseeable period of under-activity and the number of employees concerned.

- Very Small Enterprises (VSEs) facing economic hardship can postpone the payment of utility bills (water, gas, electricity) and rental payments.

Business cash-flow measures

- The French President has announced an exceptional State guarantee system to support corporate financing, up to €300 billion. This will allow banks to grant cash loans to companies of all sizes, enabling them to have the cash necessary to continue their activity and preserve employment. This is temporary, since it will only cover than loans made from March 1 to December 31 of this year.

- The Paris Region, in partnership with Bpifrance, has designed a regional emergency plan for businesses. This plan entails accelerated payment to businesses (i.e. within 30 days), an easier access to bank loans of over €1 billion through the Bpifrance Guarantee Fund, €700 million in new loans up to 7 years, 80% guaranteed up to a maximum of €6 million. The Paris Region has asked Bpifrance to pass on this loan at zero interest, as opposed to 3.8% today. The aim is to help 5,000 small and medium-sized businesses very quickly.

- SMEs affected by the coronavirus, which anticipate a fall in turnover of at least 20% can benefit from the Paris Region’s “BACK-up Prévention plan”.

- The Paris Region has implemented a Relocation pack dedicated to supporting SME’s with specific assistance in finding sites in the Paris Region, in their recruitment processes, and financial help through regional aid schemes such as PM’up and Innov’up.

- The Minister of Economy and Finance announced the creation of a solidarity fund of €1bn to support small, independent and micro-enterprises affected by regulatory activity restrictions and experiencing a significant drop in turnover.

This solidarity fund will operate at 2 levels. On the one hand, eligible companies will benefit from fast, simple and unitary support of €1,500. It will also offer a safety net for artisans, traders and small entrepreneurs particularly affected by the current situation. In addition, further support may be granted on a case-by-case basis, to avoid bankruptcy.

Part-time activity and social contributions

- A simplified and reinforced use of the part-time activity scheme is available to companies experiencing severe economic difficulties. This system, also called “partial unemployment”, enables companies to receive financial aid to offset the loss of income caused by the reduction in the working time of their employees.

- Companies may only apply for the part-time activity scheme specifying the reasons justifying the recourse to part-time activity, the foreseeable period of under-activity and the number of employees concerned.

The form can be found on: https://activitepartielle.emploi.gouv.fr/aparts/

- Please note that the setting up of the part-time activity is subject to a prior request which is normally processed within 15 days maximum. The government has specified that requests related to COVID-19 will be processed on a priority basis within 48 hours. If there is no response within 15 days, the request for part-time activity will be considered as accepted.

Compensated part-time activity

- On March 17th, 2020, the French Government announced that part-time activity would be compensated up to 84% of the net salary of employees, although a ceiling is not excluded for the highest salaries. In addition, the French Government indicated that the employer who is required to pay for the allowance will be refunded within 10 days.

Social contributions

- Deferred payment of social charges and contributions to be paid to the URSSAF (employers’ and employees’ contributions) is possible without prior authorization or penalty fees.

FAQ for businesses

- A comprehensive FAQ about the part-time activity scheme is available in English at: https://bit.ly/2UzQxTL

Legal support

- Support is available from the State and the Banque de France (credit mediation) for businesses wishing to negotiate a rescheduling of bank loans.

You can contact the Credit Mediator by filling out the following form : https://mediateur-credit.banque-france.fr/contactez-nous_mediation_credit

- Support from BPI France to guarantee bank liquidity facilities that companies may need due to the current pandemic.

- Support is available from the Business Mediator (“Médiateur des entreprises”) (https://www.economie.gouv.fr/mediateur-des-entreprises) for businesses facing a conflict in their business relationships with customers and/or suppliers. You can contact the Business Mediator by filling out the following form : https://www.economie.gouv.fr/mediateur-des-entreprises/contactez-mediateur-des-entreprises

- The State and local authorities have recognized the Coronavirus as a case of “force majeure”. Consequently, late payment penalties will not be applied for State and local authorities’ public contracts. The Paris Region has also established a “Zero penalties” scheme regarding all current public procurement contracts in the Paris Region.

- Legal information regarding the entry and residence permits of foreign talents in France is available on: https://www.welcometofrance.com/en/covid-19-%3A-entry-and-stay-of-foreign-talents-in-france

Useful information

- We strongly advise you to check the Government’s website very regularly in order to obtain the most up-to-date information: https://www.gouvernement.fr/info-coronavirus. You may also use the toll-free number (0800 130 000) for all information.

- The Ministry of Labour is updating information on the above measures and recommendations on a daily basis.

- Dedicated contact points have been set-up to support companies facing economic difficulties linked to the COVID-19 epidemic:

- Paris Region has set-up a dedicated a Covid special business support unit to help answer questions raised by businesses.

- You can reach them Monday to Friday from 9am to 6pm by phone at:

+33 (0) 1 53 85 53 85 or by email: covid-19-aidesauxentreprises@iledefrance.fr

- Companies can contact the General Directorate for Companies (Direction Générale des Entreprises) via the following address: dge@finances.gouv.fr

- For specific help with administrative procedures, companies can get in touch with the SPOC (single point of contact) of the DIRECCTE in the region where their company is located (contacts: https://www.economie.gouv.fr/coronavirus-soutien-entreprises#)

- Business France has published a set of guidelines to international companies available at: https://www.welcometofrance.com/en/government-measures-to-assist-companies-and-workers-impacted-by-covid-19 as well as a series of FAQ related to the current social measures available in English at : https://www.plateforme-attractivite.com/en/choosefrance/social-measures-reports/

- Choose Paris Region’s teams, in France, in the United States and in China, are available to answer any questions raised by international companies regarding the current situation in the Paris Region. Our Team’s contact details are available here.